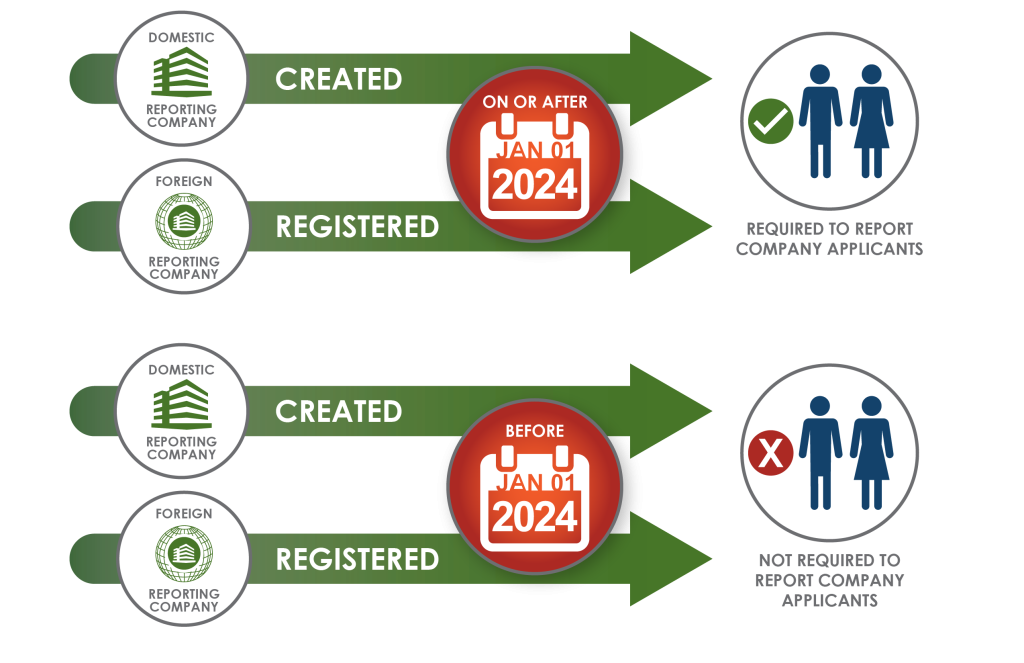

Boi Reporting 2025 California. Businesses formed on or after january 1, 2025 must file an initial boi report within 90 days. The latest developments in beneficial ownership information (boi) reporting.

With the new beneficial ownership information (boi) rule taking effect on. Of treasury | fincen.gov | privacy policy | accessibility.

Boi Reporting 2025 California Imelda Philly, Reporting entities registered with a secretary of state or equivalent office before.

Fincen Boi Reporting 2025 Reporting Jacqui Shelagh, Today, the financial crimes enforcement network (fincen) issued a final rule.

Boi Reporting 2025 Form Julia Joletta, The boi reporting mandate applies to the beneficial owners and controlling.

Boi Reporting 2025 California Imelda Philly, Reporting companies created or registered before january 1, 2025, have until january 13, 2025, to file their initial boi reports with fincen.

BOI Reporting Regulations Effective January 2025 Cherry Bekaert, For existing california llcs, boi reports must be filed before january 1, 2025.

Fincen BOI Reporting (Beneficial Ownership Information Reporting, You will need to file a beneficial ownership information (boi) report with the treasury.

Boi Reporting For 2025 Fanya Giovanna, Companies created in 2025 have 90 days from their creation date to file boi reports, while the deadline for companies created before 2025 is jan.

Boi Reporting 2025 Requirements 2025 Ardine Margaretha, Of treasury | fincen.gov | privacy policy | accessibility.

Fincen Boi Reporting 2025 Reporting Jacqui Shelagh, You will need to file a beneficial ownership information (boi) report with the treasury.